A Complete List Of ICB Courses

- Business Management: Accredited ICB Courses

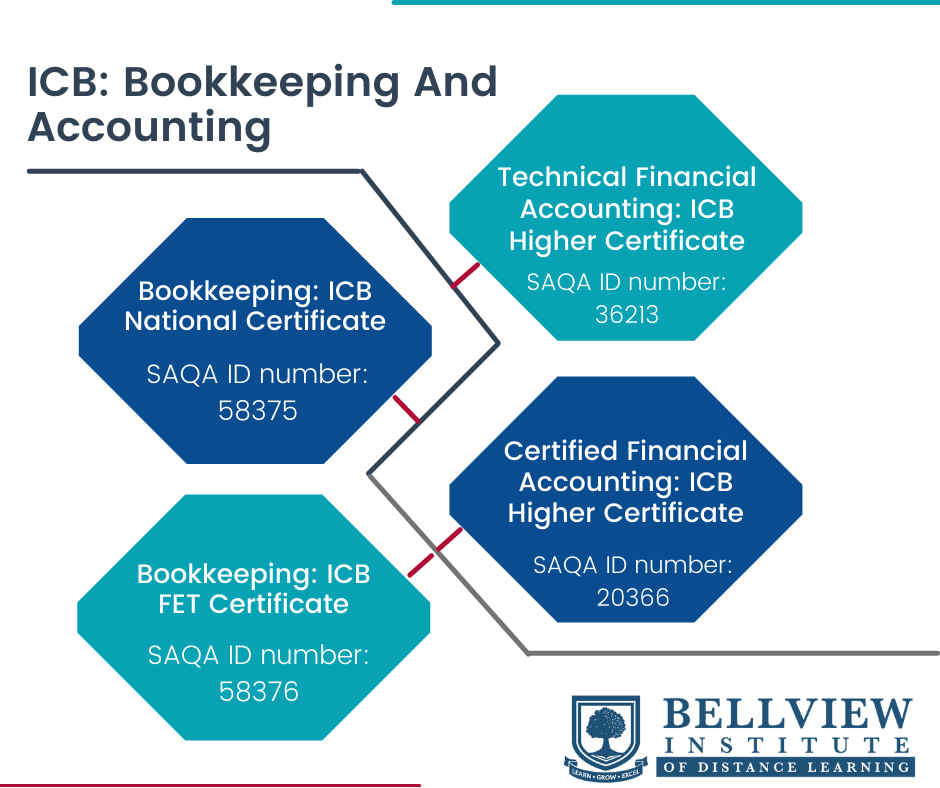

- Bookkeeping And Accounting: Accredited ICB Courses

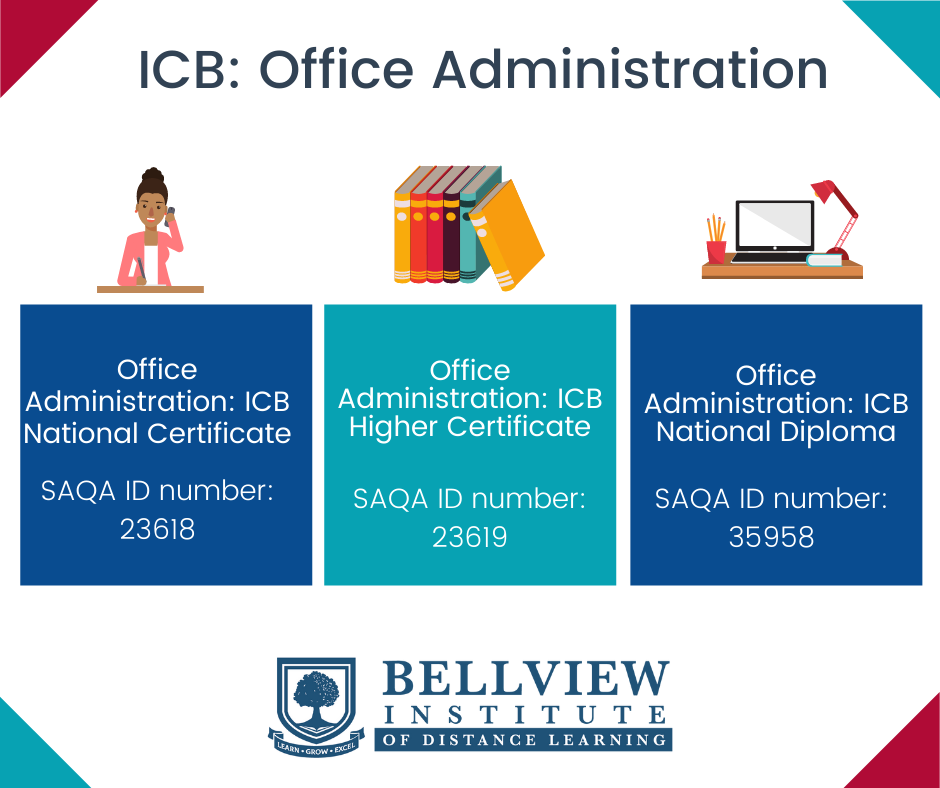

- Office Administration: Accredited ICB Courses

- Matric Equivalent (NQF 4): Accredited ICB Courses

Designed and offered by the ICB (Institute of Certified Bookkeepers) are several courses that centre around fields such as management, accounting, and administration. These courses are made to prepare students for the business world.

View the ICB Courses Brochure here: https://bellview.edu.za/download-brochure/icb-courses/

Accredited by the ICB, the following courses are offered by Bellview Institute of Distance Learning:

ICB: Business Management Courses

There are three levels in the ICB Business Management Programme

- Small Business Financial Management: ICB National Certificate (NQF Level 4) – SAQA ID Number: 48736

- Office Administration – Business Management: ICB Higher Certificate (NQF Level 5) – SAQA ID Number: 23619

- Financial Accounting – Business Management: ICB National Diploma (NQF Level 6) – SAQA ID Number – 20366

View the ICB Business Management Courses Brochure here: https://bellview.edu.za/download-brochure/business-management-courses/

ICB: Bookkeeping And Accounting Courses

There are four levels in the ICB Bookkeeping And Accounting Programme

- Bookkeeping: ICB National Certificate (NQF Level 3) – SAQA ID Number: 58375

- Bookkeeping: ICB FET Certificate (NQF Level 4) – SAQA ID Number: 58376

- Certified Financial Accounting: ICB National Diploma (NQF Level 5) – SAQA ID Number: 36213

- Technical Financial Accounting: ICB National Diploma (NQF Level 6) – SAQA ID Number: 20366

View the ICB Bookkeeping and Accounting Courses Brochure here: https://bellview.edu.za/download-brochure/bookkeeping-and-accounting-courses/

ICB: Office Administration Courses

There are three levels in the ICB Office Administration Programme

- Office Administration: ICB National Certificate (NQF Level 5) – SAQA ID Number: 23618

- Office Administration: ICB Higher Certificate (NQF Level 5) – SAQA ID Number: 23619

- Office Administration: ICB National Diploma (NQF Level 6) – SAQA ID Number: 35958

View the ICB Office Administration Courses Brochure here: https://bellview.edu.za/download-brochure/office-administration-courses/

ICB: Matric Equivalent Courses

ICB has three Matric Equivalent Certificates

- Bookkeeping: ICB National Certificate (NQF Level 3) – SAQA ID Number: 58375

- Bookkeeping: ICB FET Certificate (NQF Level 4) – SAQA ID Number: 58376

- Small Business Financial Management: ICB National Certificate (NQF Level 4) – SAQA ID Number: 48736

Why You Should Study An ICB Course

Choosing to study one or more of the ICB courses offered through Bellview Institute of Distance Learning holds many benefits, such as:

- Gaining of Scarce Skills: Every field of study offered by the ICB is regarded and listed as scarce skills. This means that individuals who hold any ICB qualification will always be in demand

- Increase in your Employability: Because your qualification will hold many different scarce skills, finding a job will be easier as potential employers prefer ICB qualifications

- You will have Job Security: The qualifications offered by the ICB are not likely to be automated and therefore you will not have to be concerned about job security

- Working while you study: Completing your ICB qualification via distance learning means that you can work to earn a salary while you complete your studies

Recognition Of ICB Qualifications

Offered only through a select number of accredited educational institutions, ICB courses are designed to provide students with credible and recognised (both nationally and internationally) business qualifications. This includes Financial Management, Business Management, and Office Administration.

ICB qualifications remain valid indefinitely, meaning there is no expiration date or renewal applications for these qualifications. Regardless of what you choose to do after getting your ICB qualification, that qualification remains accredited, recognised, and valid.

Bellview Institute of Distance Learning Accreditation

Accredited to offer ICB courses to students, Bellview holds the following accreditation:

- Institute Of Certified Bookkeepers – ICB Courses: 301089

- Quality Council For Trades And Occupations (QCTO): 301089

- Department of Higher Education and Training – Distance Learning Exam Number (DHET Exams Division): 01999921101199995016

View Accreditation Certificates here.

ICB Business Management Courses

Small Business Financial Management: ICB National Certificate

SAQA ID Number: 48736

Qualification Title: Small Business Financial Management: ICB National Certificate

Qualification Type: National Certificate

Originator: SGB GET & FET Business, Commerce and Management Studies

Course Credits: 120

NQF Level: 04

Instructional Offering/Exit Level Outcomes:

The qualifying learner will be able to:

- Record business transactions and prepare statements

- Calculate Value Added Tax (VAT) and prepare tax returns

- Calculate gross pay and deductions

- Prepare IRP 5s as required by legislation

- Interpret final accounts as per organisational requirements

- Calculate the cost of products and distinguish between fixed and variable costs, carry out break-even analysis and calculate selling prices

- Prepare a business plan and budget

- Communicate effectively in the workplace

- Critical Cross-Field Outcomes:

The learner who acquires this qualification should be able to demonstrate the ability to:

- Make organisational payments

- Calculate Value Added Tax using VAT rules and rates

- Calculate gross wages from time records

- Make adjustments for stock evaluation, depreciation, and bad debts

- Calculate the level of the working capital required in the business

- Draw up financial business plans

Office Administration: ICB Higher Certificate

Qualification Title: Office Administration: ICB Higher Certificate

Qualification Type: National Higher Certificate

Originator: Institute of Administration and Commerce

Course Credits: 240

NQF Level: 05

Instructional Offering/Exit Level Outcomes:

- Cost and Management Accounting

- Economics

- Human Resources Management

- Labour Relations

- Management

- Law

- Business and Office Administration

Critical Cross-Field Outcomes:

The learner who acquires this qualification should be able to demonstrate the ability to:

- Allocate overheads to calculate recovery rates

- Use these rates to calculate recoveries, and know how to treat under- or over-recoveries

- Prepare a budgeted income statement and balance sheet

- Evaluate capital budgets

- Identify revenue and cost curves to highlight marginal revenues and costs

- Compute prices

- Produce cash flow statements

- Determine strengths and weaknesses in policy to prepare a more suitable policy

- Calculate marginal cost of capital

- Discuss the effects of financial leverage

- Explain the different forms of available finance

Financial Accounting: ICB National Diploma

Qualification Title: Financial Accounting: ICB National Diploma

Qualification Type: Advanced Certificate

Originator: The Institute of Certified Bookkeepers Pty Ltd

Course Credits: 280

NQF Level: 06

Instructional Offering/Exit Level Outcomes:

- Competence in all areas of Financial Accounting

- Cost and Management Accounting

- Understanding and applying tax regulations in the field of personal and business taxation

- Understanding of the nature of law and the role of law within which an accountant operates

- Competence in all areas of Financial Management

- Demonstrates an understanding of internal and external auditing processes

- Understanding of Information Systems in business

- Demonstrates understanding of the key marketing and management theories, concepts, and techniques operating within business organisations

- Understands and applies sound accounting theory and practice

- Demonstrates knowledge and understanding of Management Accounting control systems

- Understanding of Financial Accounting on the Regulatory Framework

- Knowledge of corporate strategy

Critical Cross-Field Outcomes:

The learner who acquires this qualification should be able to demonstrate:

- Competence in the principles underlying Bookkeeping and Accounting

- Cost and Management Accounting techniques operating within business organisations

- Understanding the structure and operation of the taxation system

- Explaining the operation of the Legal System about Common Law, Equity and Judicial Precedent, Civil Law, Criminal Law, Statute Law, Case Law, and EC Law

- Making effective and relevant decisions in the area of Financial Management

- An understanding of the principles of Auditing and the role of professional and legal bodies relating to the audit function

- Applying key marketing and management theories

- Skills in information selection, retrieval, analysis, synthesis, evaluation, and criticism of Accountancy-related problems or issues

ICB Bookkeeping And Accounting Courses

Bookkeeping: ICB National Certificate

Qualification Title: Bookkeeping: ICB National Certificate

Qualification Type: National Certificate

Originator: SGB HET Accountancy and Financial Management

Course Credits: 120

NQF Level: 03

Instructional Offering/Exit Level Outcomes:

The qualifying learner will be able to:

- Administer credit purchase and credit sales transactions

- Apply knowledge of income, receipts, payments, and expenses

- Administer Value Added Tax (VAT) transactions

- Complete reconciliation statements, general ledger accounts, and trial balances

- Administer petty cash

- Apply knowledge and understanding of personal taxation

- Apply knowledge of business taxation

- Record business financial transactions

Critical Cross-Field Outcomes:

The learner who acquires this qualification should be able to demonstrate:

- Identify and solve problems by thinking and making responsible decisions

- Work with others as a member of a team

- Organise and manage him/herself and his/her activities responsibly and effectively

- Collect, analyse, organise and critically evaluate the performance

- Communicate well using mathematical and language skills

- Demonstrate an understanding of the world as a set of related systems by recognising that problem-solving situations do not exist in isolation

- Benefit by full personal development, thus contributing to the social and economic development of South African society at large

Bookkeeping: ICB FET Certificate

Qualification Title: Further Education and Training Certificate: Bookkeeping

Qualification Type: Further Education and Training Certificate

Originator: SGB HET Accountancy and Financial Management

Course Credits: 130

NQF Level: 04

Instructional Offering/Exit Level Outcomes:

The qualifying learner will be able to:

- Finalise and interpret accounts

- Interpret and draft financial statements

- Maintain financial records and prepare general ledger accounts

- Calculate and record Value Added Tax transactions and complete VAT returns

- Establish, maintain and use a computerised bookkeeping system

Critical Cross-Field Outcomes:

The learner who acquires this qualification should be able to demonstrate the ability to:

- Identify and solve problems by thinking and making responsible decisions

- Work with others as a member of a team

- Organise and manage him/herself and his/her activities responsibly and effectively

- Collect, analyse, organise and critically evaluate the performance

- Communicate well using mathematical and language skills

- Demonstrate an understanding of the world as a set of related systems by recognising that problem-solving situations do not exist in isolation

- Benefit by full personal development, thus contributing to the social and economic development of South African society at large

Technical Financial Accounting: ICB National Diploma

Qualification Title: National Diploma: Technical Financial Accounting

Qualification Type: National Diploma

Originator: SGB HET Accountancy and Financial Management

Course Credits: 251

NQF Level: 05

Instructional Offering/Exit Level Outcomes:

The qualifying learner will be able to:

- Process documents relating to goods and services supplied and received

- Maintain records relating to capital acquisition and disposal

- Input, store, and output data

- Provide costing reports

- Highlight trends in costs and make suggestions for the reduction of costs and adding value to the organisation

- Prepare cost estimates for work activities and projects

- Contribute to the planning and conducting of an audit

- Classify and record Accounting and non-financial data.

- Take responsibility for the management of cash and credit.

- Perform tax computations, prepare returns for businesses and individuals and submit all required tax returns

Critical Cross-Field Outcomes:

The learner who acquires this qualification should be able to demonstrate the ability to:

- Administer the estate of deceased persons

- Assist with the winding up of an insolvent estate and the liquidation of a company within the context of financial management

- Interpret statutes and the basic structures of the South African legal system within the context of the Accounting profession

Certified Financial Accounting: ICB National Diploma

Qualification Title: National Diploma: Financial Accounting

Qualification Type: Advanced Certificate

Originator: The Institute of Certified Bookkeepers Pty. Ltd.

Course Credits: 280

NQF Level: 06

Instructional Offering/Exit Level Outcomes:

The qualifying learner:

- Has acquired knowledge of, and demonstrates competence in all areas of Financial Accounting

- Demonstrates knowledge of, and competence in all areas of Cost and Management Accounting

- Understands and applies tax regulations in the field of personal and business taxation

- Demonstrates a sound understanding of the nature of law and an appreciation of the role of law within which an accountant operates

- Has acquired knowledge of, and demonstrates competence in all areas of financial management

- Demonstrates an understanding of Internal and External Auditing processes

- Has acquired an understanding of Information Systems in business

- Demonstrates knowledge and understanding of the key marketing and management theories, concepts, and techniques operating within business organisations

- Understands and applies sound Accounting theory and practice

- Demonstrates knowledge and understanding of Management Accounting Control systems

- Has acquired an understanding of Financial Accounting in respect of the Regulatory Framework

- Demonstrates knowledge and understanding of corporate strategy

Critical Cross-Field Outcomes:

The qualifying learner:

- Understands and demonstrates competence in the principles, concepts, and conventions underlying Bookkeeping and Accounting

- Understands and demonstrates the Cost and Management Accounting concepts and techniques operating within business organisations, including the internal management of a business within a changing environment

- Understands the structure and operation of the system of taxation within his/her own country

- Can explain the operation of the Legal System concerning Common Law, Equity and Judicial Precedent, Civil Law, Criminal Law, Statute Law, Case Law, and EC Law

- Is competent in making effective and relevant decisions in the area of Financial Management

- Demonstrates an understanding of the principles of Internal and External Auditing and the role of professional and legal bodies relating to the audit function

- Applies the key marketing and management theories, concepts, and techniques to diagnose, analyse, resolve and understand the nature of management and marketing problems

- Has developed skills in information selection, retrieval, analysis, synthesis, evaluation, and criticism of Accountancy-related problems or issues

- Displays knowledge and understanding of the application of Management Accounting control and decision-making techniques, which enables him/her to communicate more effectively as an Accountant

- Displays a comprehensive knowledge and understanding of Financial Accounting concerning the Regulatory Framework and its application to financial reporting

- Has acquired knowledge of the principle concepts and models used in the Strategic Management process and understands their contribution to improving business performance

ICB Office Administration Courses

Office Administration: ICB National Certificate

Qualification Title: Certificate: Office Administration

Qualification Type: National Certificate

Originator: Institute of Administration and Commerce

Course Credits: 120

NQF Level: 05

Instructional Offering/Exit Level Outcomes:

- Communication

- Public Relations

- Administrative Practice

- Business and Office Administration

- Financial Accounting

- Cost and Management Accounting

- Marketing

Critical Cross-Field Outcomes:

The qualifying learner will:

- Understand, identify and apply concepts of communication theory

- Understand the background and context of communication

- Explain how corporate personalities make use of individuals to think and act for them

- Demonstrate an understanding of the role and function of a secretary in the organisation

- Apply fundamental accounting equations

- Identify and understand the basic concepts of Cost and Management Accounting

- Demonstrate the ability to allocate and apportion overheads to calculate rates of recovery

- Explain the nature of the marketing process

Office Administration: ICB Higher Certificate

Qualification Title: Higher Certificate: Office Administration

Qualification Type: National Higher Certificate

Originator: Institute of Administration and Commerce

Course Credits: 240

NQF Level: 05

Instructional Offering/Exit Level Outcomes:

- Cost and Management Accounting

- Economics

- Human Resources Management

- Labour Relations

- Management

- Law

- Business and Office Administration

Critical Cross-Field Outcomes:

- Demonstrate the ability to allocate and apportion overheads to calculate rates of recovery

- Demonstrate an understanding of the economic problem

- Describe various organisational structures and discuss their respective merits and demerits

- Demonstrate a sound appreciation of organisational and functional relationships in an organisation

- Demonstrate an understanding of the background and development of industrial relations in South Africa

- Demonstrate an understanding of the interaction and processes within the labour relationship

- Demonstrate an understanding of the personnel function as it affects the role of the supervisor

- Demonstrate knowledge of the nature, sources, and classification of the law.

- Demonstrate an understanding of the concept of ergonomics and its contribution to conducive working conditions

Office Administration: ICB National Diploma

Qualification Title: Diploma: Office Administration

Qualification Type: National Diploma

Originator: Institute of Administration and Commerce

Course Credits: 360

NQF Level: 06

Instructional Offering/Exit Level Outcomes:

- Financial Accounting

- Administrative Practice

- Human Resources Management

- Public Relations

- Management

- Law

- Business and Office Administration

Critical Cross-Field Outcomes:

- Demonstrate an understanding of the framework for the preparation and presentation of financial statements

- Form and administer a close corporation

- Demonstrate detailed knowledge of the Companies Act, the Close Corporations Act, and the Insider Trading Act

- Explain the meaning and nature of Organisational Behaviour

- Plan a public relations programme for any given situation. This implies being able not only to interpret case material reasonably accurately but also being able to show the reasoned and systematic application of principles and techniques in solving the communication problem inherent in the material presented

- Demonstrate an understanding of how management theories have developed

- Explain, using practical, work-related examples, aspects of the marketing process, and the integrated marketing strategy in an organisation

- Effectively and efficiently use all available resources to maximise the organisation`s survivability, growth (future expansion), profitability

- Demonstrate an understanding of management functions and organisational structure

What Are ICB Courses?

Known as the ICB, the Institute of Certified Bookkeepers acts as an independent and external examination body for accredited business qualifications in South Africa. These courses aim to provide education in several business-related qualifications.

Each of the ICB courses is made of three to five different levels. Depending on which course you choose to study, this course can start as an NQF Level 4 qualification. As you progress through the available ICB courses you will eventually be awarded an NQF Level 6 qualification. NQF Level 6 qualifications are National Diploma qualifications.

What Will I Learn In An ICB Course?

Since each ICB course branches off into different directions, the skills, and tools you will learn to cover a broad spectrum of subject matter. Depending on which course you choose you will learn skills in management, accounting, and administration.

Every ICB qualification includes both theoretical and practical education, used within a business environment, which aims to improve your:

- Management Skills

- Critical Thinking

- Strategic Planning

- Leadership Abilities

- Flexibility

- Communication Skills

ICB Courses Offered By Bellview Institute Of Distance Learning

Available to students via distance learning, Bellview Institute of Distance Learning, offers three main ICB study streams, which consist of several different courses.

ICB Business Management

Business Management is the combination of three different courses. These courses represent a foundational level, an intermediate level, and an advanced level.

Business Management Courses

- Small Business Financial Management: ICB National Certificate (NQF Level 4)

- Office Administration – Business Management: ICB Higher Certificate (NQF Level 5)

- Financial Accounting – Business Management: ICB National Diploma (NQF Level 6)

Small Business Financial Management: ICB National Certificate

Entry Requirements

For you to apply to study the first course in your ICB Business Management qualification, you will need to have either a Grade 11 certificate or equivalent.

Subjects

During your Small Business Financial Management: ICB National Certificate you will study the following subjects:

- Introduction to Business English

- Business Management 1 (BMT1)

- Bookkeeping to Trial Balance (BKTB)

- Business Literacy (BUSL)

Course Duration

To complete your Small Business Financial Management: ICB National Certificate will take you 12 months.

Award Type

Upon completion of this course, you will be awarded your Small Business Financial Management: ICB National Certificate.

Office Administration – Business Management: ICB Higher Certificate

Entry Requirements

To apply to study the second course in your ICB Business Management qualification, you will need to successfully complete your Small Business Financial Management: ICB National Certificate.

Subjects

During your Office Administration – Business Management: ICB Higher Certificate, you will study the following subjects:

- Office and Legal Practice (OLPR)

- Business Management 2 (BMT2)

- Marketing Management and Public Relations (MMPR)

- Financial Statements (FNST)

- Human Resources Management and Labour Relations (HRLR)

Course Duration

To complete your Office Administration – Business Management: ICB Higher Certificate will take you 12 months.

Award Type

Upon completion of this course, you will be awarded your Office Administration – Business Management: ICB Higher Certificate.

Financial Accounting – Business Management: ICB National Diploma

Entry Requirements

To apply to study the third course in your ICB Business Management qualification, you will need to successfully complete both your Small Business Financial Management: ICB National Certificate and your Office Administration – Business Management: ICB Higher Certificate.

Subjects

During your Financial Accounting – Business Management: ICB National Diploma, you will study the following subjects:

- Business Management 3 (BMT3)

- Financial Management and Control (FMCL)

- Financial Reporting and Regulatory Frameworks (FRRF)

- Research Theory and Practice (by short dissertation, topic: Business Management) (RTAP)

Course Duration

To complete your Financial Accounting – Business Management: ICB National Diploma will take you 12 months.

Award Type

Upon completion of this course, you will be awarded your Financial Accounting – Business Management: ICB National Diploma.

ICB Bookkeeping and Accounting

Aimed at those who have a love for numbers and finances, the range of ICB Bookkeeping and Accounting consists of four courses. These courses represent a foundational level, intermediate level, upper-intermediate level, and advanced level.

Financial Accounting Courses

- Bookkeeping: ICB National Certificate (NQF Level 3)

- Bookkeeping: ICB FET Certificate (NQF Level 4)

- Technical Financial Accounting: ICB National Diploma (NQF Level 5)

- Certified Financial Accounting: ICB National Diploma (NQF Level 6)

Bookkeeping: ICB National Certificate

Entry Requirements

To apply to study the first course in your ICB Financial Accounting qualification you will need to have completed your Grade 10 or an equivalent qualification.

Subjects

During your Bookkeeping: ICB National Certificate, you will study the following subjects:

- Introduction to Business English

- Bookkeeping to Trial Balance (BKTB)

- Payroll and Monthly SARS Returns (PMSR)

- Computerised Bookkeeping (CPBK)

- Business Literacy (BUSL)

Course Duration

To complete your Bookkeeping: ICB National Certificate will take you up to 12 months to complete.

Award Type

Upon completion of this course, you will be awarded your Bookkeeping: ICB National Certificate.

Bookkeeping: ICB FET Certificate

Entry Requirements

To apply to study the second course in your ICB Financial Accounting qualification, you will need to have completed your Bookkeeping: ICB National Certificate.

Subjects

During your Bookkeeping: ICB FET Certificate, you will study the following subjects:

- Introduction to Business English

- Bookkeeping to Trial Balance (BKTB)

- Payroll and Monthly SARS Returns (PMSR)

- Computerised Bookkeeping (CPBK)

- Business Literacy (BUSL)

- Financial Statements (FNST)

- Cost and Management Accounting (CMGT)

Course Duration

To complete your Bookkeeping: ICB FET Certificate will take you up to 12 months.

Award Type

Upon completion of this course, you will be awarded your Bookkeeping: ICB FET Certificate.

Technical Financial Accounting: ICB National Diploma

Entry Requirements

To apply to study the third course in your ICB: Financial Accounting qualification you will need to have completed your previous two ICB Bookkeeping and Accounting courses.

Subjects

During your Technical Financial Accounting: ICB National Diploma you will study the following subjects:

- Introduction to Business English

- Bookkeeping to Trial Balance (BKTB)

- Payroll and Monthly SARS Returns (PMSR)

- Computerised Bookkeeping (CPBK)

- Business Literacy (BUSL)

- Financial Statements (FNST)

- Cost and Management Accounting (CMGT)

- Income Tax Returns (ITRT)

- Business Law and Accounting Control (BLAC)

Course Duration

To complete your Technical Financial Accounting: ICB National Diploma will take you up to 12 months.

Award Type

Upon completion of this course, you will be awarded your Technical Financial Accounting: ICB National Diploma.

Certified Financial Accounting: ICB National Diploma

Entry Requirements

To apply to study the fourth and final course in your ICB Financial Management qualification you will need to have completed the previous three ICB Bookkeeping and Accounting courses.

Subjects

During your Certified Financial Accounting: ICB National Diploma course you will study the following subjects:

- Introduction to Business English

- Bookkeeping to Trial Balance (BKTB)

- Payroll and Monthly SARS Returns (PMSR)

- Computerised Bookkeeping (CPBK)

- Business Literacy (BUSL)

- Financial Statements (FNST)

- Cost and Management Accounting (CMGT)

- Income Tax Returns (ITRT)

- Business Law and Accounting Control (BLAC)

- Corporate Strategy (CRPS)

- Management Accounting Control Systems (MACS)

- Financial Reporting and Regulatory Frameworks (FRRF)

- Research Theory and Practice (in the short dissertation; topic: financial accounting) (RTAP)

Course Duration

To complete your Certified Financial Accounting: ICB National Diploma will take you up to 12 months.

Award Type

Upon completion of this course, you will be awarded your Certified Financial Accounting: ICB National Diploma.

ICB Office Administration

Designed by the ICB, studying office administration, is perfect for individuals who have excellent organisational, and communication skills. Students of office administration will need to have a natural ability to work with people as well.

Office Administration Courses

- Office Administration: ICB National Certificate (NQF Level 5)

- Office Administration: ICB Higher Certificate (NQF Level 5)

- Office Administration: ICB National Diploma (NQF Level 6)

Office Administration: ICB National Certificate

Entry Requirements

To apply to start your studies towards your ICB Office Administration qualification, you will need to have either a Matric or equivalent certificate.

Subjects

During your Office Administration: ICB National Certificate course you will study the following subjects:

- Introduction to Business English

- Business and Office Administration 1 (BOA1)

- Bookkeeping to Trial Balance (BKTB)

- Business Literacy (BUSL)

- Marketing Management and Public Relations (MMPR)

- Business Law and Administrative Practice (BLAP)

- Cost and Management Accounting (CMGT)

Course Duration

To complete your Office Administration: ICB National Certificate will take you 12 months.

Award Type

Upon completion of this course, you will be awarded your Office Administration: ICB National Certificate.

Office Administration: ICB Higher Certificate

Entry Requirements

To apply to study the second course in your ICB Office Administration qualification, you will need to have completed your Office Administration: ICB National Certificate.

Subjects

During the course of your Office Administration: ICB Higher Certificate you will study the following subjects:

- Introduction to Business English

- Business and Office Administration 1 (BOA1)

- Bookkeeping to Trial Balance (BKTB)

- Business Literacy (BUSL)

- Marketing Management and Public Relations (MMPR)

- Business Law and Administrative Practice (BLAP)

- Cost and Management Accounting (CMGT)

- Business and Office Administration 2 (BOA2)

- Human Resource Management and Labour Relations (HRLR)

- Economics (ECS)

Course Duration

To complete your Office Administration: ICB Higher Certificate will take you 12 months.

Award Type

Upon completion of this course, you will be awarded your Office Administration: ICB Higher Certificate.

Office Administration: ICB National Diploma

Entry Requirements

To apply to study the third and final course for your ICB Office Administration qualification, you will need to have completed both the Office Administration: ICB National and Higher Certificates.

Subjects

During your Office Administration: ICB National Diploma course you will study the following subjects:

- Introduction to Business English

- Business and Office Administration 1 (BOA1)

- Bookkeeping to Trial Balance (BKTB)

- Business Literacy (BUSL)

- Marketing Management and Public Relations (MMPR)

- Business Law and Administrative Practice (BLAP)

- Cost and Management Accounting (CMGT)

- Business and Office Administration 2 (BOA2)

- Human Resource Management and Labour Relations (HRLR)

- Economics (ECS)

- Business and Office Administration 3 (BOA3)

- Financial Statements (FNST)

- Management (MGMT)

Course Duration

To complete your Office Administration: ICB National Diploma will take you 12 months.

Award Type

Upon completion of this course, you will be awarded your Office Administration: ICB National Diploma.

Career Opportunities

ICB Business Management

Upon successful completion of your ICB Business Management qualification, you can choose to pursue one of the following careers:

- Business Analyst estimated monthly salary: R 39 700

- Human Resource Manager, estimated monthly salary: R 48 800

- Payroll Administrator estimated monthly salary: R 32 200

- Sales Manager estimated monthly salary: R 57 400

- Marketing Manager estimated monthly salary: R 57 400

Business Analyst

As a Business Analyst, you will be responsible for the effective and efficient improvement of the systems and processes used by a business or company.

Roles And Responsibilities

Some of the tasks and responsibilities you will have as a Business Analyst include:

- The conducting of research and analysis is needed to determine solutions for any problem that might arise within a business or company

- The introduction of new and improved systems that can be used within a business or company

- Determining better and improved business practices and systems to prevent potential issues from arising

Estimated Salary

As a Business Analyst your expected monthly salary is R39 700, and an estimated R476 400 annually. This is dependent on your level of experience and employment agreement.

Human Resource Manager

As a Human Resource Manager, you will be directly involved with the leading and direction of routine personnel functions within a company or business.

Roles And Responsibilities

Some of the tasks and responsibilities you will have as a Human Resource Manager include:

- The process of hiring and interviewing new employees

- The administration of pay, leave, and employee benefits

- Managing daily workflow

- Conducting performance evaluations and providing feedback

Estimated Salary

As a Human Resource Manager your expected monthly salary is R48 80, and an estimated R585 600 annually. This is dependent on your level of experience and your employment agreement.

Payroll Administrator

As a Payroll Administrator, you will be responsible for all of the duties relating to payroll within a company or business.

Roles And Responsibilities

As a Payroll Administrator some of the tasks and responsibilities you will have include:

- Ensuring that employees work their expected work hours

- The calculation of wages and salaries

- Deduction of tax payments

- Record keeping of bank transactions

Estimated Salary

As a Payroll Administrator your expected monthly salary is R32 200, and an estimated R386 400 annually. This is dependent on your level of experience and your employment agreement.

Sales Manager

As a Sales Manager, you will be responsible for the sales, revenues, and expenses of a business or company.

Roles And Responsibilities

Some of your tasks and responsibilities as a Sales Manager include:

- The development of business plans to meet set sales goals

- The setting of targets for the sales team

- Keeping track of both sales and goals

- Reporting of results from sales plans

Estimated Salary

As a Sales Manager your estimated monthly salary is R57 400, and an estimated R688 800 annually. This is dependent on your level of experience and your employment agreement.

Marketing Manager

Being a Marketing Manager means you will be responsible for the brand positioning and promotion of a business or company.

Roles And Responsibilities

As a Marketing Manager, the following will be part of your responsibilities:

- Designing new and effective marketing campaigns

- The effective and profitable launching of new products and services

- Creating new marketing plans

- Evaluation of potential products or services

Estimated Salary

As a Marketing Manager your estimated monthly salary is R57 400, and an estimated R688 800 annually. This is dependent on your level of experience and your employment agreement.

ICB Financial Accounting

Upon successful completion of your ICB Financial Accounting qualification, you can choose to pursue one of the following careers:

- Financial Accountant estimated monthly salary: R 21 900

- Tax Consultant estimated monthly salary: R 34 200

- Management Accountant estimated monthly salary: R 25 500

- Financial Controller, estimated monthly salary: R 35 100

- Financial Analyst estimated monthly salary: R 39 900

Financial Accountant

As a Financial Accountant, you will be responsible for running the financial and accounting activities of a business.

Roles And Responsibilities

Some of your tasks and responsibilities as a Financial Accountant include:

- The creation of tax reports

- Processing and keeping track of inventory

- Examining the accuracy of financial records

- Determining estimates for project funding

Estimated Salary

As a Financial Accountant your estimated monthly salary is R21 900, and an estimated R262 800 annually. This is dependent on your level of experience and your employment agreement.

Tax Consultant

As a Tax Consultant, it will be your job to ensure that businesses make well-informed decisions regarding any and all tax-related matters.

Roles And Responsibilities

Some of your tasks and responsibilities as a Tax Consultant include:

- Preparing of tax returns

- Providing relevant and correct tax-related information to clients

- Effective communication of tax rules and regulations within a business

- The calculation of taxes owed

Estimated Salary

As a Tax Consultant your estimated monthly salary is R34 200, and an estimated R410 400 annually. This is dependent on your level of experience and your employment agreement.

Management Accountant

As a Management Accountant, you will be responsible for running all accounting tasks required to operate a business or company.

Roles And Responsibilities

Some of your tasks and responsibilities as a Management Accountant include:

- The organisation of financial tasks

- Development and structuring of budgets

- Continuous monitoring of costs and revenue trends

- The strategic planning and allocation of resources

Estimated Salary

As a Management Accountant your estimated monthly salary is R25 500, and an estimated R306 000 annually. This is dependent on your level of experience and your employment agreement.

Financial Controller

As a Financial Controller, you will be responsible for ensuring that all financial and accounting records are accurate and kept up to date, as well as meeting company standards.

Roles And Responsibilities

Some of your tasks and responsibilities as a Financial Controller include:

- Development of financial strategies

- Preparing financial analysis for reporting

- Management of cash flow

- Consolidation of budgets

Estimated Salary

As a Financial Controller your estimated monthly salary is R35 100, and an estimated R421 200 annually. This is dependent on your level of experience and your employment agreement.

Financial Analyst

As a Financial Analyst, you will be responsible for keeping track of any and all financial plans of a business or company.

Roles And Responsibilities

Some of your tasks and responsibilities as a Financial Analyst include:

- The analysis of financial data and performance

- Preparation of analysis reports

- Evaluation of profit plans

- Investigation of potential investment opportunities

Estimated Salary

As a Financial Analyst your estimated monthly salary is R39 900, and an estimated R478 800 annually. This is dependent on your level of experience and your employment agreement.

ICB Office Administration

Upon successful completion of your ICB Office Administration qualification, you can pursue the following careers:

- Marketing Administrator estimated monthly salary: R 57 400

- Human Resource Administrator, estimated monthly salary: R 29 500

- Office Manager estimated monthly salary: R 27 600

- Debtors Clerk estimated monthly salary: R 16 000

- Receptionist estimated monthly salary: R 15 300

Marketing Administrator

As a Marketing Administrator, you will be responsible to promote companies and the products they offer to increase brand awareness.

Roles And Responsibilities

As a Marketing Administrator some of the tasks and responsibilities you will have include:

- Periodic market research

- Development and implementation of marketing strategies

- Communication of brand values and virtues

Estimated Salary

As a Marketing Administrator your expected monthly salary is R57 400, and an estimated R688 800 annually. This is dependent on your level of experience and your employment agreement.

Human Resource Administrator

As a Human Resource Administrator, you will be responsible to support the entire Human Resource department as a link between employees and employers.

Roles And Responsibilities

As a Human Resource Administrator some of the tasks and responsibilities you will have include:

- Organisation and maintenance of personnel records

- Keeping the Human Resource database up to date

- Preparation of any Human Resource related documents

Estimated Salary

As a Human Resource Administrator your expected monthly salary is R29 500, and an estimated R354 000 annually. This is dependent on your level of experience and your employment agreement.

Office Manager

As an Office Manager, you will be responsible for the efficient functioning of an office environment.

Roles And Responsibilities

As an Office Manager some of the tasks and responsibilities you will have include:

- Organisation of meetings and conferences

- The management of databases

- The organisation of instruction processes for new employees

Estimated Salary

As an Office Manager your expected monthly salary is R27 600, and an estimated R331 200 annually. This is dependent on your level of experience and your employment agreement.

Debtors Clerk

As a Debtors Clerk, you will be responsible for the creation and maintenance of customer account records.

Roles And Responsibilities

As a Debtors Clerk some of the tasks and responsibilities you will have include:

- Effective tracking of amounts paid and owed

- The calculation of interest on overdue accounts

- Preparation of bank statements

Estimated Salary

As a Debtors Clerk your expected monthly salary is R16 000, and an estimated R192 000 annually. This is dependent on your level of experience and your employment agreement.

Receptionist

Being a Receptionist means you will be the first contact point between employees, employers, and customers. You will be responsible for multiple administrative and organisational tasks.

Roles And Responsibilities

As a Receptionist some of the tasks and responsibilities you will have include:

- The greeting of clients

- Scheduling of appointments and meetings

- The organising and updating of records

- Handling of all correspondence

Estimated Salary

As a Receptionist, your expected monthly salary is R15 300, and an estimated R183 600 annually. This is dependent on your level of experience and your employment agreement.

Benefits Of Studying With Bellview Institute of Distance Learning

Studying one of the ICB courses via distance learning has many different benefits. Choosing Bellview Institute of Distance Learning has the following advantages:

- Continued Support – Our expertly trained and experienced support staff are at your service and will offer any assistance you might need. Your questions or concerns will be answered within 24 to 48 hours

- Course Material Delivery – After completing your registration, Bellview compiles all of your course materials and couriers them directly to your door, within five to seven business days

- Timely Feedback – All of your assessments and assignments will be marked as soon as possible after submission and in-depth feedback will be provided to you shortly after that

- Anytime Registration – When deciding on where to study keep in mind that with Bellview you can register at any time during the year

- Access to Study Groups – After you have fully registered for your course you will be given access to several specifically designed WhatsApp and Facebook support groups. You will also gain access to the Together We Pass platform to engage with your fellow students and your tutors

- Multiple Application Methods – Registering with Bellview is easy and simple, most importantly, it can be done in several ways, such as:

- Landline Application – Contact our registration team on 0800 39 00 27, weekdays between 08:00 and 17:00

- Contact one of our course specialists directly

- Complete our online application here

Why You Should Choose To Study An ICB Course Via Distance Learning

Completing your studies using distance learning is quickly becoming the best way to further your studies. By choosing Bellview, you can expect to experience the following benefits:

- Study Where You Feel Comfortable – As distance learning does not have any classroom education, you have the advantage of choosing wherever you feel comfortable to complete your studies

- No Transport Costs – Seeing as there are no physical lessons you will not have to travel in between classes, which will save you a lot of money

- Setting Your Own Pace – With distance learning you receive all of your course materials at the same time, which means you can set your own study pace

- Work and Study At The Same Time – Having the opportunity to work either full or part-time whilst completing your distance learning course is a major benefit to have

- Cost-Effective – Distance learning is considered to be extremely cost-effective, as the costs are not inflated due to classroom education

Frequently Asked Questions

Are Diploma Courses Easy?

As with any other academic course, when you commit and persevere, your studies will be a breeze. Diploma courses are no different, with the only exception being that they will require you to actively study and prepare thoroughly before your exams. Doing so guarantees success.

Where Do I Go After ICB?

Upon completion of any of the ICB courses, there are several future options to choose from, such as:

- Enter the workforce in your field of study, in either an entry-level or intermediate level position

- Further your studies by completing other ICB courses

- Registering with a professional body and pursuing a career

What Are ICB Courses?

ICB courses are accredited courses, designed by the Institute of Certified Bookkeepers, aiming to educate students in either management, accounting, or administration.

Are ICB Courses Accredited?

Yes, every ICB course is both accredited and recognised. The full range of ICB courses is recognised both nationally and internationally, meaning you will have a valid qualification anywhere in the world.

Is Bookkeeping A Dying Profession?

Although there is advanced automation in many different careers, Bookkeeping remains one of these careers that will not be easily completed by any machine. You can rest assured that a career in bookkeeping is not a bad choice.

Does UNISA Recognise ICB Qualifications?

Most higher learning institutions, such as UNISA, do not automatically give credits for ICB subjects. Applying for admission using your ICB NQF Level 6 will be beneficial when your application is brought up for consideration.

Is ICB Recognised In South Africa?

All of the ICB qualifications are registered on the National Qualifications Framework (NQF) meaning that they are recognised nationally as well as accredited.

Who Is ICB?

There are 3 study programmes offered to Matric College students and they are:

- Financial Accounting

- National Certificate in Junior Bookkeeping

- FET Certificate in Senior Bookkeeping

- National Diploma in Technical Financial Accounting

- National Diploma in Certified Financial Accounting

- Business Management

- Small Business Financial Management: ICB National Certificate

- Business Management Office Administration: ICB Higher Certificate

- Business Management Financial Accounting: ICB National Diploma

- Office Administration

No Matric? No problem! You can apply to do your Online Matric via distance learning at Matric College. The Matric Courses on offer are:

- Matric Rewrite

- Matric Upgrade

- National Senior Certificate or Senior Certificate (Amended) depending on your age when you complete your studies

- Adult Matric

- Matric Equivalent

Author: Morné van Emmenis

Editor: Elzanne Louwrens